LendingAI

One-stop Solution for

Lending IntelligenceSeamlessly convert financial documents to Structured Data and Consumable Reports

No code, Low Touch GenAI for Unsecured and Secured Lending

LendingAI is a single platform to automate Loan Risk Lifecycle

Document Collection & Verification

Extract financial documents with built-in validation and a self-learning algorithm.

Signal Extraction for Risk Modelling

Automatically view risk signals in a credit report based on your credit model.

Credit Decision & Line Allocation

Make faster decisions, reducing turnaround time and improving customer satisfaction.

Disbursal & Monitoring

Upload quarterly documents to our fully automated platform for real-time risk updates in hours.

Fast, accurate extraction with built-in validation tailored to each document

LendingAI supports all parts of Document Processing

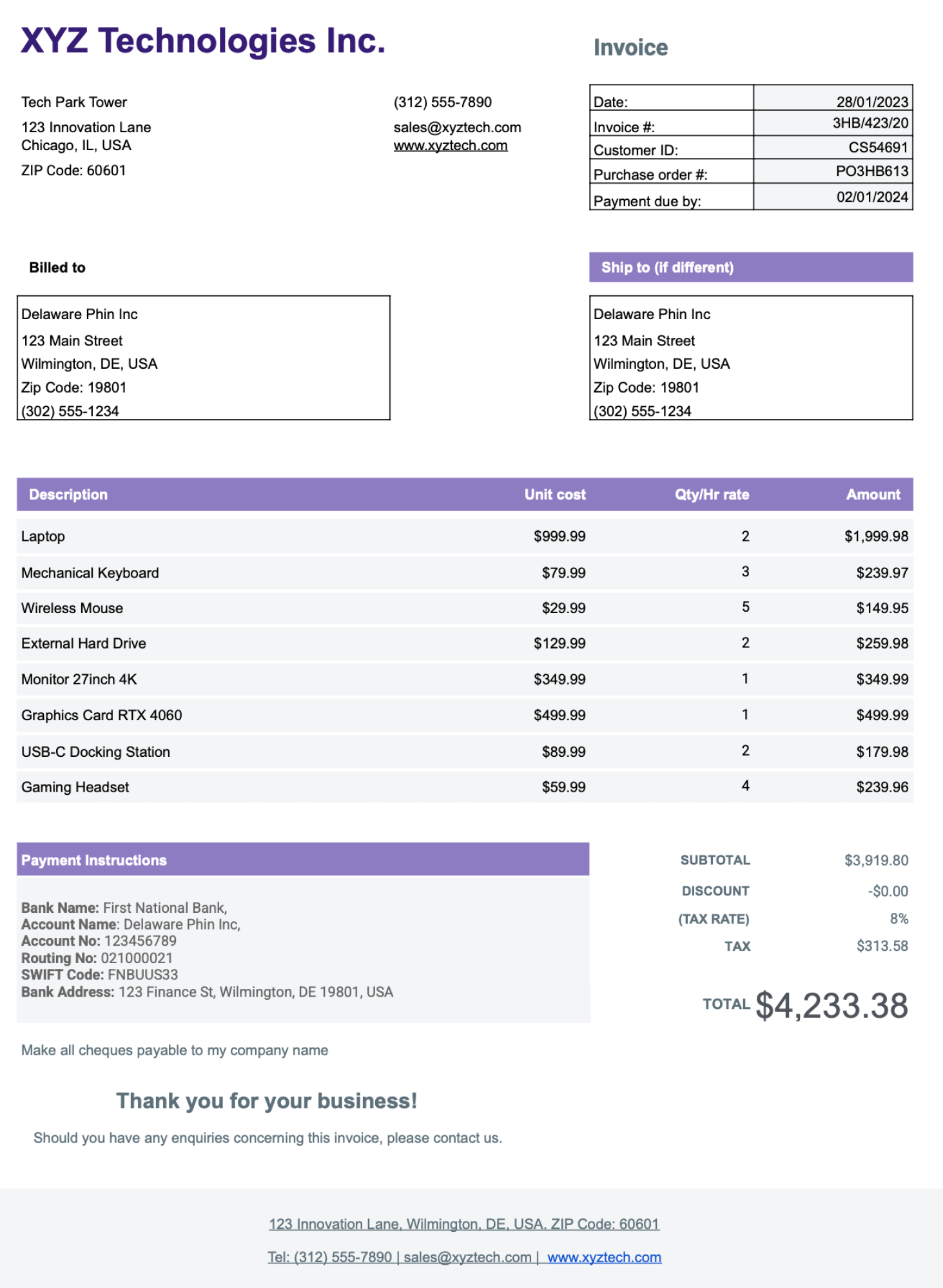

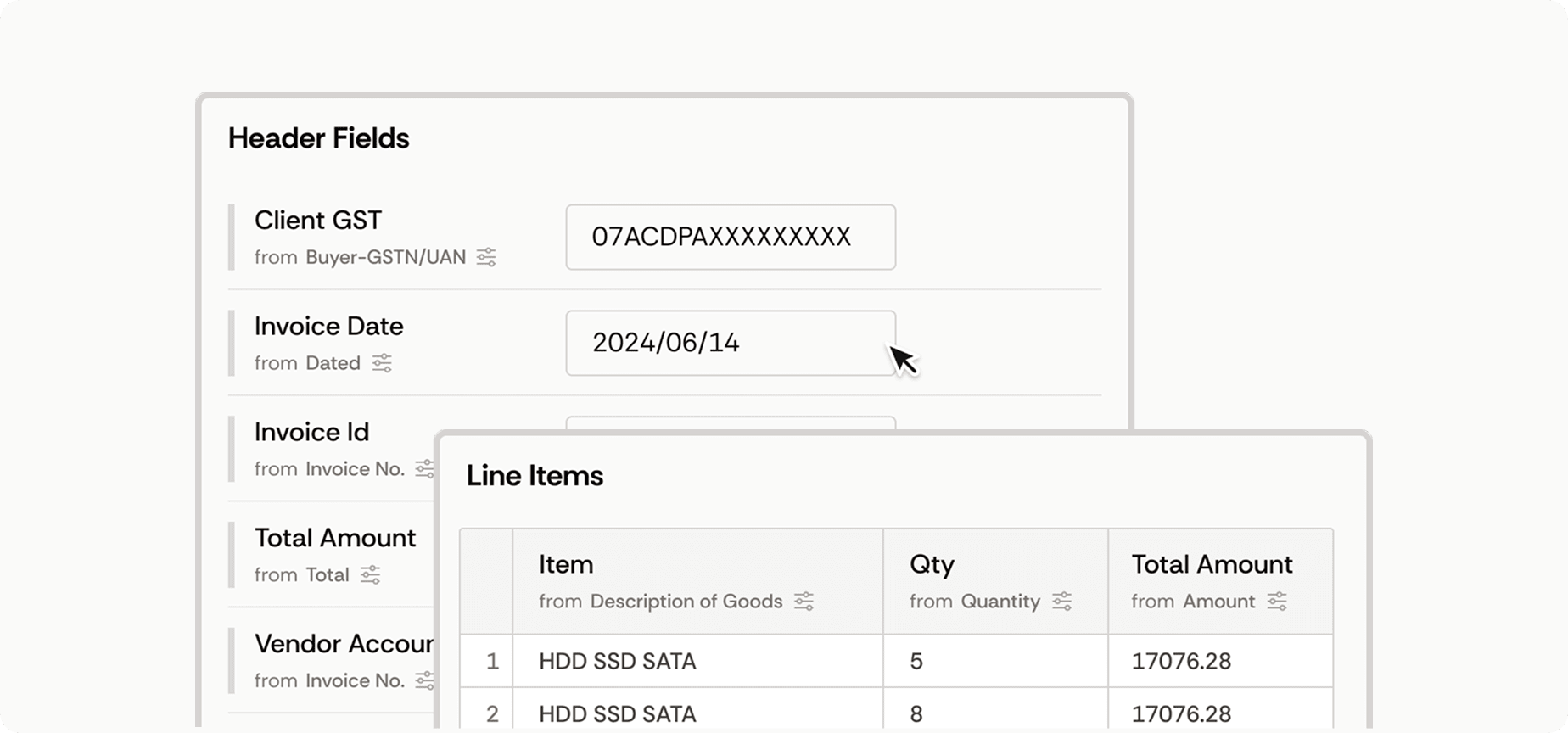

Extract Headers and Line Items

LendingAI identifies and extracts Header Fields and Line Items from Financial Documents separately.

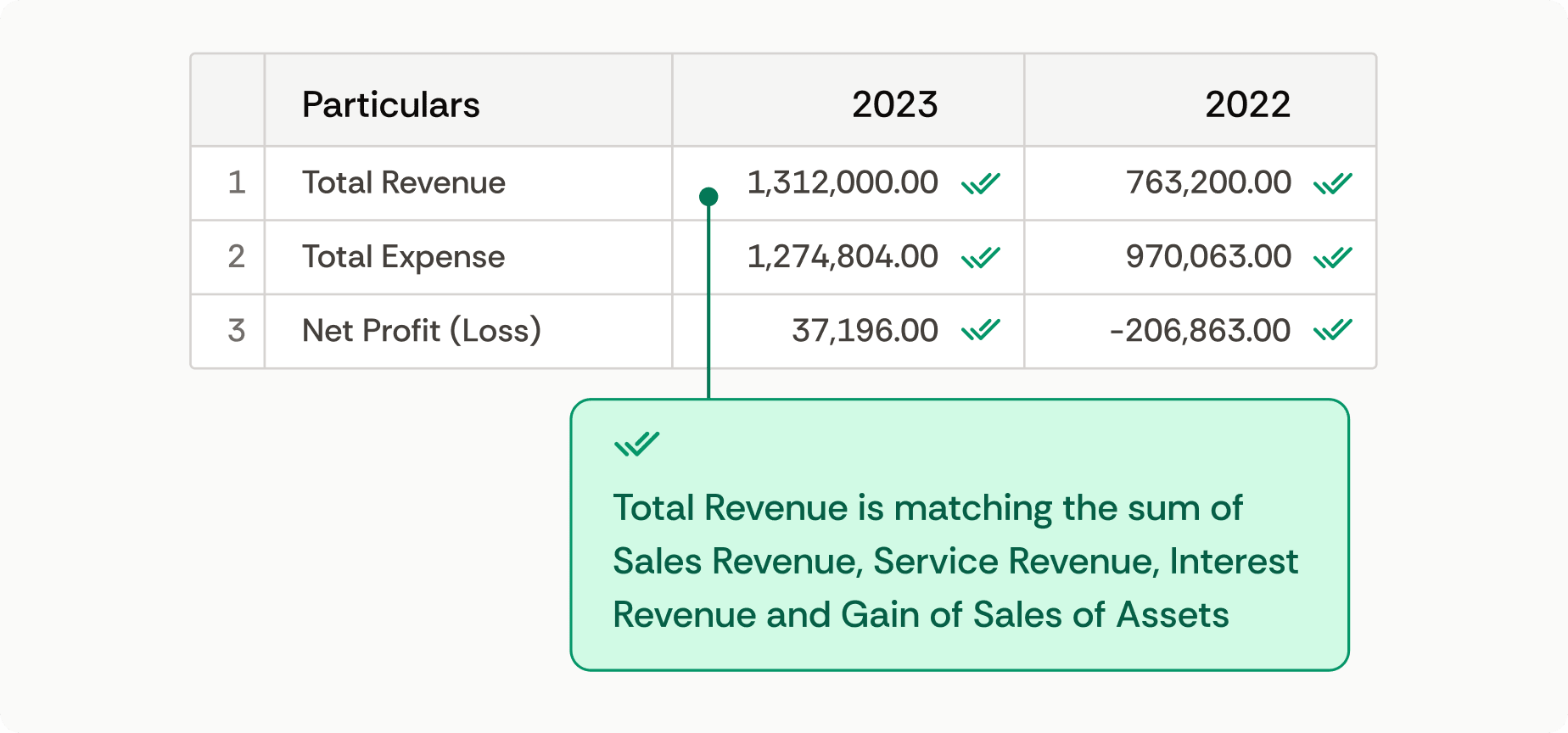

In-document Validation

Set rules to auto-validate fields using arithmetic calculations to quickly identify anomalies.

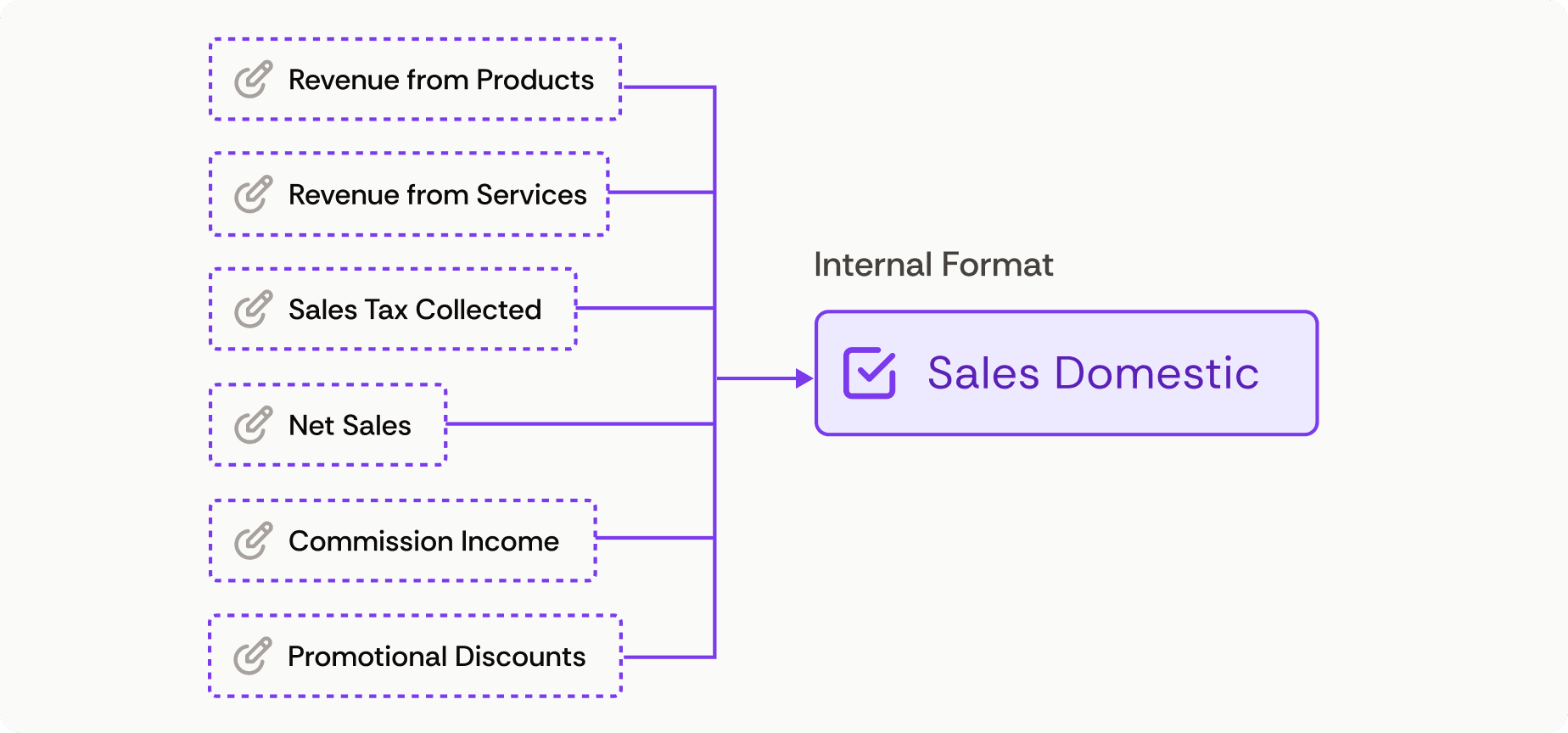

Auto-map to Internal Formats

Extracted particulars are mapped to internal formats for seamless structured extraction.

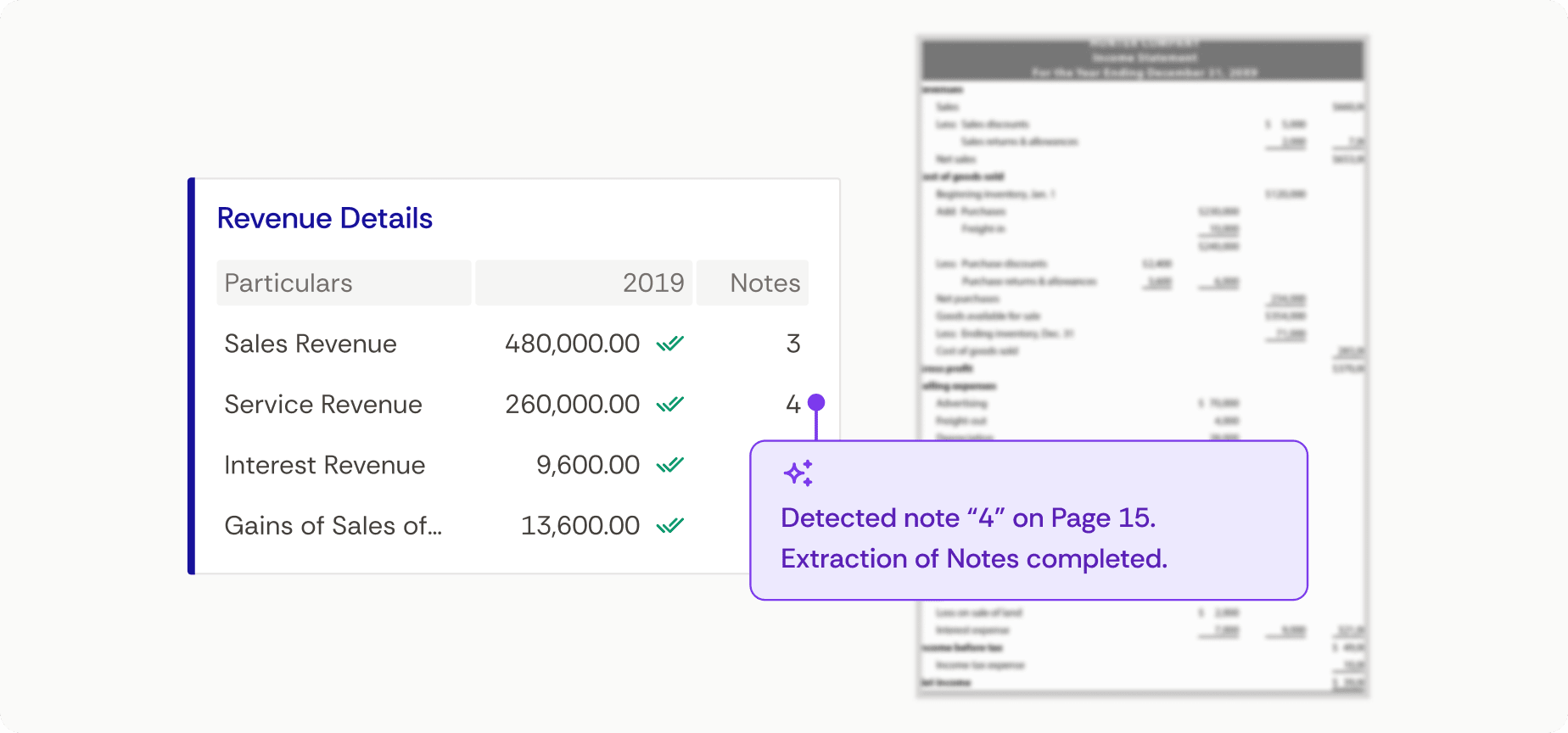

Notes extraction in multi-step Documents

Automatically identify and fetch notes from a annexe to validate a particular or extract details.

LendingAI uses your documents to generate risk reports, warning signals and track covenants

LendingAI supports all parts of Risk Analysis and Monitoring

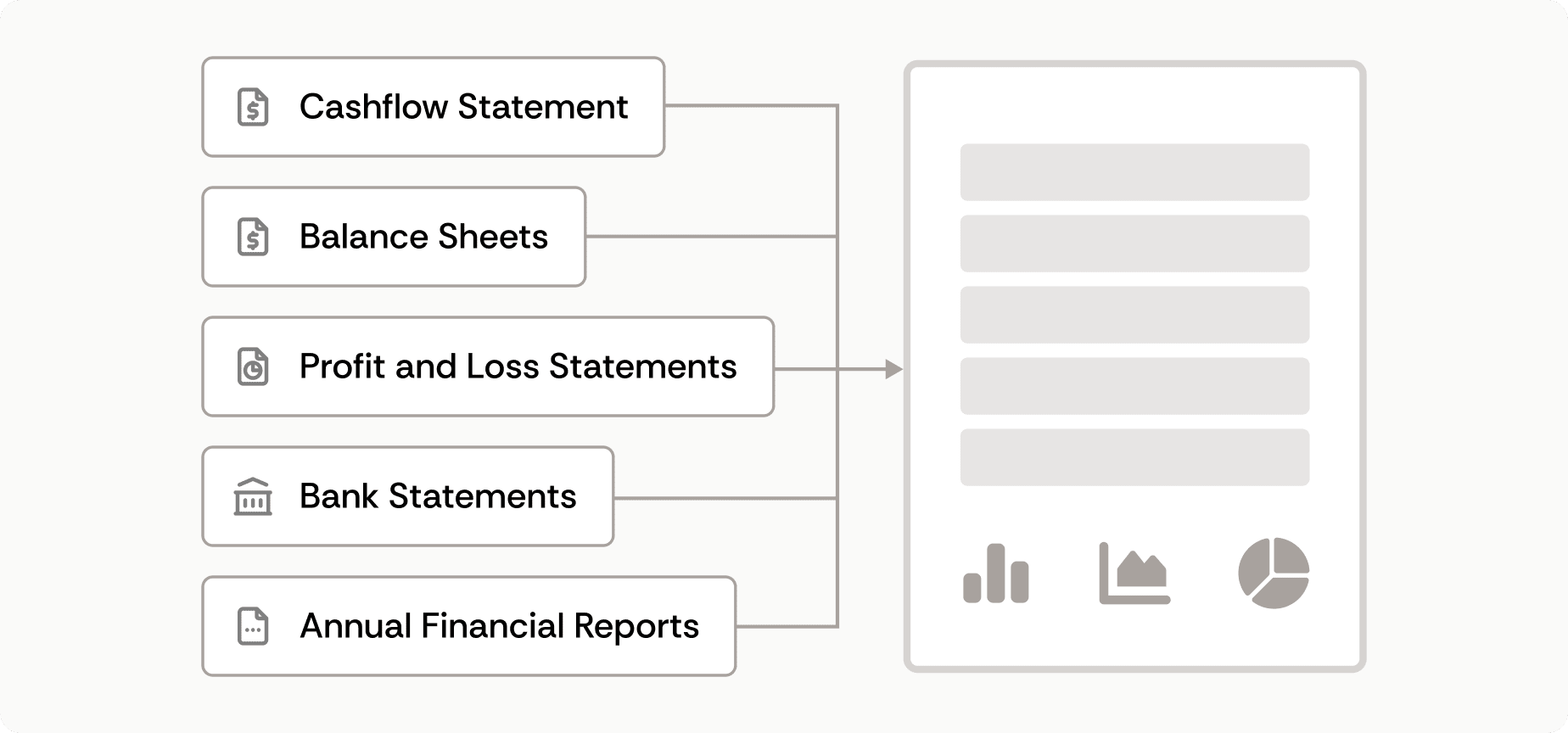

Automated Analytics

LendingAI can take multiple financial documents and give a consolidated report for early warnings and risk signals.

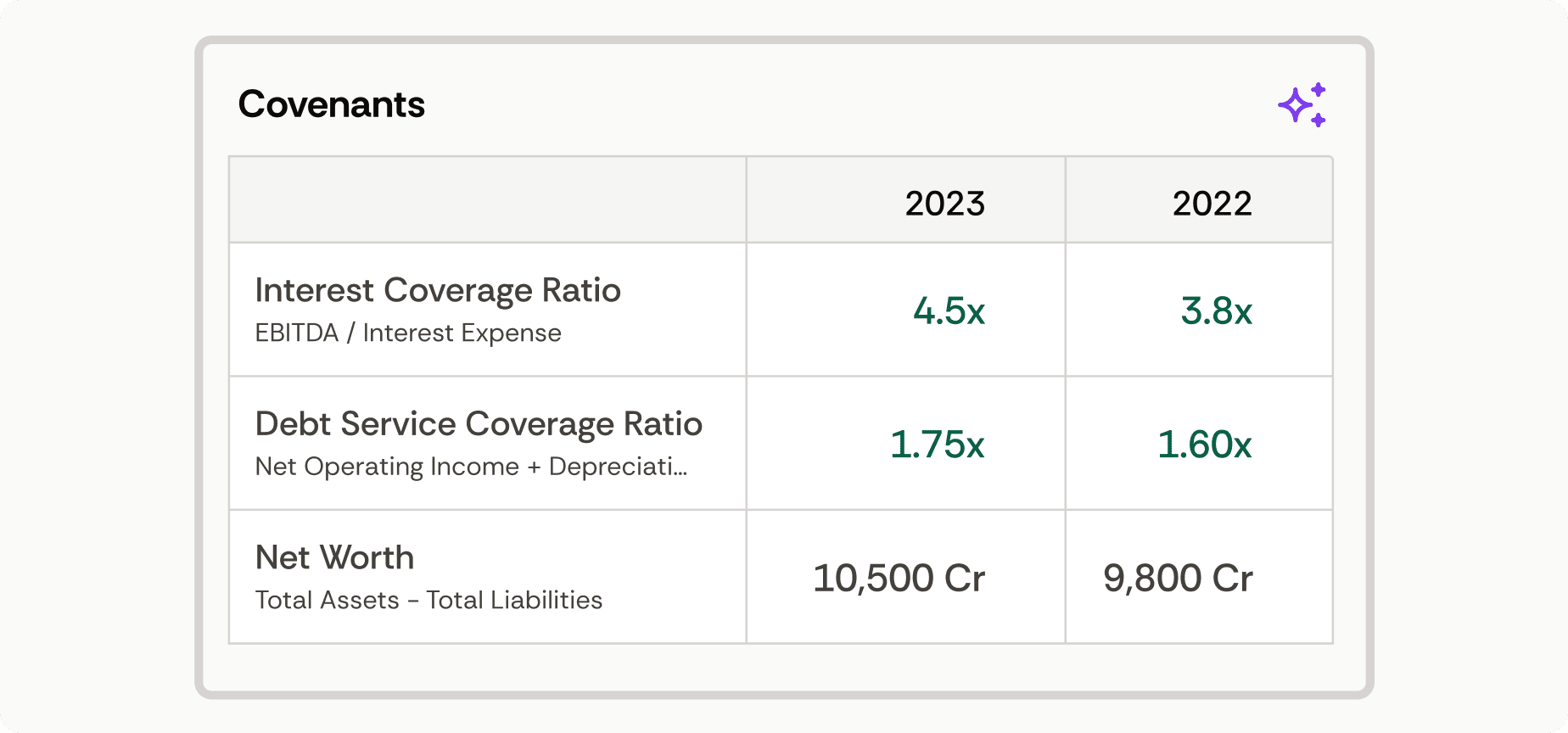

Track Covenants and Metrics

Track AI-generated key covenants & metrics to ensure compliance & make informed decisions.

15+ ready to use document templates, with more added every month

LendingAI understands your Domain and your Context

The power of AI now at your finger tips

Extract data with up to 99% accuracy

Build your own credit model (BYOC)

Automated Signals for Early warnings

One-stop Solution for Lending Intelligence

Understand how we can help your lending business

What our customers say

Effortlessly sync your account payable data into ERP systems, ensuring accuracy and consistency at every touchpoint.

Invoice straight through processing crossed over 85%+

Our invoice straight through processing increased by 22% after switching to DocsAI from our previous OCR based solution. We were able to integrate DocsAI into our platform and go live in the same day. The feedback capability has been a great plus to consistently improve our auto disbursal accuracy.

Chaitanya Adapa

Head , Udaan Capital

The vishwa.ai Advantage

Simple Interface

Gain complete control and speed with a simple no-code interface, enabling every feature without any hassle.

Integrate with your Apps

Effortlessly integrate with major platforms in the click of a button. Integrate with in-house apps using our APIs.

Built by Experts

We have built production ready AI products for 20+ yrs. We work closely with business experts to solve the right problems.

Ask Anything

We are here to serve your doubts anytime. Feel free to reach out to us.

I allow vishwa.ai to contact me for scheduling and marketing, as per terms of use and privacy policy.

Talk to our team

Book a free 30-minute consultation with our AI experts at your preferred time.

Discover how vishwa.ai can benefit your business.

Pricing that suites you

Demo of workflow setup

Personalised onboarding support

Company

Integrations

OTHER TOOLS

Extract Documents like Invoices, Financial Statements, Bank Statements, Purchase Orders, Bill of Lading, and more.